maine tax rates by town

Select the Maine city from the list of popular cities below to see its current sales tax rate. Find your Maine combined state and local tax rate.

Counties in Maine collect an average of 109 of a propertys assesed fair market value as property tax per year.

. Franklin County 125 percent. Current Land Use Programs. How does Maines tax code compare.

13 rows Tax Rates Maine Revenue Services Tax Rates The following is a list of individual. Property Tax Resources Statistics. These tax rates are calculated in order to facilitate equitable comparisons.

Combined with the state sales tax the highest sales tax rate in Maine is 55 in the cities of Portland Bangor Lewiston South Portland and Augusta and 104 other cities. There are a total of 1 local tax jurisdictions across the state collecting an average local tax of NA. Local tax rates in Maine range from 550 making the sales tax range in Maine 550.

Full value tax rates for years 2011 - 2020 PDF Municipal Information Listing. Municipalities may by vote determine the rate of interest that shall apply to taxes that become delinquent during a particular taxable year until those taxes are paid in full. Full Value Tax Rates Each year Maine Revenue Services determines the full equalized value of each municipality and subsequently calculates a full value tax rate.

The maximum rate of interest that can be charged per Title 36 MRSA. 27 rows The personal and corporate income tax generated 30 of that total and the sales tax. Maine has recent rate changes Wed Jan 01 2014.

Maine has a graduated individual income tax with rates ranging from 580 percent to 715 percent. Maine collects a state income tax at a maximum marginal tax rate of spread across tax brackets. The median property tax in Maine is 193600 per year for a home worth the median value of 17750000.

Tax Data Statistics. Maine Property Tax Institute online - May17-18 2022 Registration. Like the Federal Income Tax Maines income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

This map shows effective 2013 property tax rates for 488 Maine cities and towns. Maine ME Sales Tax Rates by City The state sales tax rate in Maine is 5500. Full Value Tax Rates.

Current Revenue Sharing Projections. Delinquent Tax Rates - Maximum Allowed. There are no local taxes beyond the state rate.

Maine is ranked number twenty out of the fifty states in order of the average amount of property taxes collected. Section 5054 is as follows. The combined budget would increase the property tax rate by 27 cents per 1000 of assessed value.

Municipal Valuation Statistical Summary Report. Property Tax Educational Programs. There is no applicable county tax city tax or special tax.

Maine Property Tax School Belfast August 1-5 2022 IAAO Course. Maine has a 550 percent state sales tax rate and does not levy any local sales taxes. Click here for a larger sales tax map or here for a sales tax table.

Our office is also staffed to administer and oversee the property tax administration in the unorganized territory. Maine also has a corporate income tax that ranges from 350 percent to 893 percent. Heres an overview of the average effective property tax rates in those areas listed from lowest to highest within this group.

ESTIMATED FULL VALUE TAX RATES State Weighted Average Mill Rate 2020 Equalized Tax Rate derived by dividing 2020 Municipal Commitment by 2022 State Valuation with adjustments for Homestead and BETE Exemptions and TIFs Full Value Tax Rates Represent Tax per 1000 of Value EAGLE LAKE 1445 1575 1679 1650 1564 1618 1565 1458 1455 1466. Ad Compare Your 2022 Tax Bracket vs. The minimum combined 2022 sales tax rate for Old Town Maine is.

Maine sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. The base state sales tax rate in Maine is 55.

This Map Explains Why Midwesterners Find New Yorkers Weird History Mystery Of History Historical Maps

The Southeast Women To Women Conference Is Coming Up I M Going Are You Womens Conference Women Unite The Hamptons

The Most Popular Beer Brands In America Map Most Popular Beers Popular Beers Beer Brands

2013 New Hampshire Tax Rates For Lakes Region Town Sorted By Town And By Rate New Hampshire Town Names Winnipesaukee

Property Tax Updates In Pakistan After Budget 2019 20 Online Real Estate Property Tax Pakistan

Lakes Region Of New Hampshire Ossipee Lake Lake Winnipesaukee Lake

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map

Walmart Lowe S Among Big Retailers Scheming To Avoid Maine Property Taxes Beacon Property Tax Walmart Tax

Cigarette Excise Taxes In Select States Per Pack Infographic Http On Wsj Com K81nby Infographic The Selection Tax

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Irs Form 1040 Instructions Tax Year 2018 Form 1040 Included In 2022 Irs Forms Irs Tax Forms Internal Revenue Service

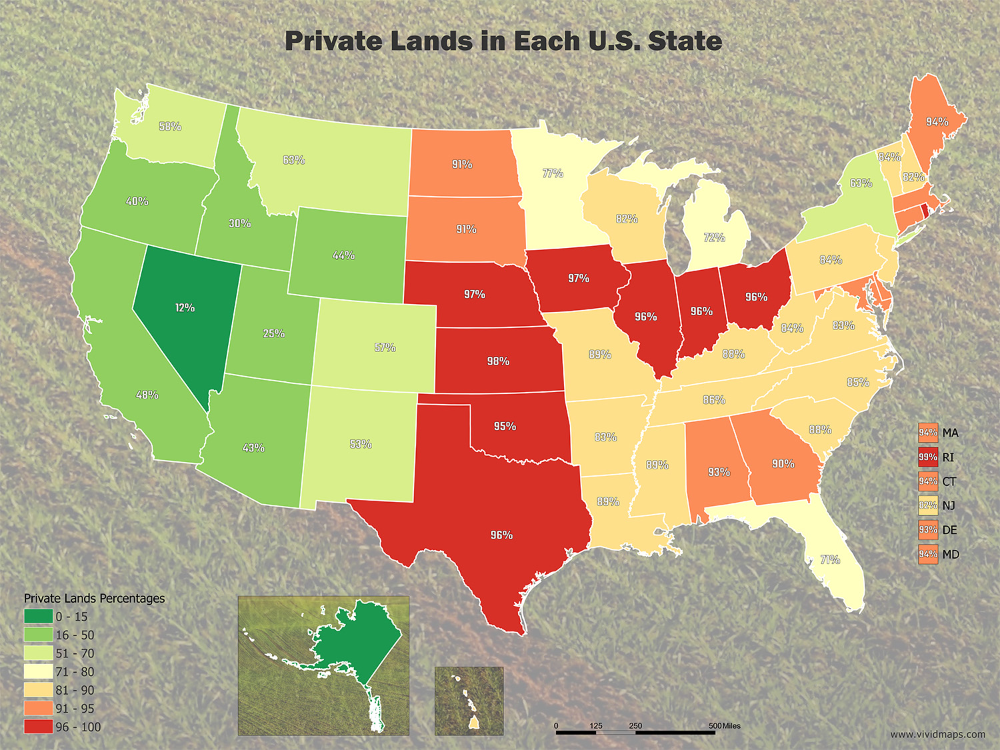

Value Of Private Land In The U S Mapped Vivid Maps Places In America Grand Canyon National Park Us Map

Chart Current Mortgage Closing Costs Listed By State Closing Costs Mortgage Interest Mortgage

The Left Vs A Carbon Tax The Odd Agonizing Political Battle Playing Out In Washington State West Virginia Illinois Missouri